Is there a name for buying a put and selling a call at the same strike? What is the downside risk? - Quora

stocks - Why doesn't someone choose the lowest Strike Price when choosing an CALL option? - Personal Finance & Money Stack Exchange

Multi-leg Options Positions (Part 2 — Call Spreads and Put Spreads) | by Cryptarbitrage | Deribit Official | Medium

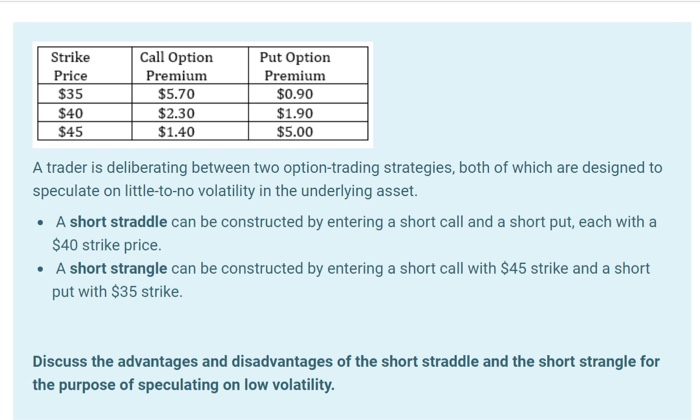

A trader buys a call option with a strike price of $40 and a put option with a strike price of $40. Both options have the same maturity. The call costs $3

:max_bytes(150000):strip_icc()/Straddle-final-ff46283479d54024a431e8aee76bf5f6.png)

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

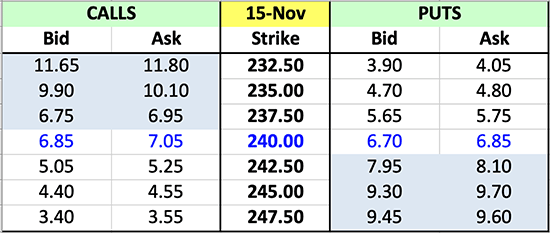

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)